Published: October 6th, 2021

The Klaytn project is a public blockchain launched in June 2019 to provide an accessible user experience and a better environment in the blockchain industry. This project includes both public and private blockchain with an efficient hybrid design that may catch the attention of startup and enterprise people.

GroundX is the company behind the Klaytn blockchain, run by a PhD holder in electrical engineer from the Korea Advanced Institute of Science and Technology. The best of the Klaytn blockchain is that it does not require strong knowledge to join the chain or create your chain. Anyone can launch their token economy on the Klaytn system that may catch mass user adoption. As the ecosystem is entirely decentralized, people can find and develop suitable applications for them.

Klaytn has successfully caught investors attention to institutional investors like Wemade Tree and Human Space. Therefore, the KLAY/USDT has multiple reasons for showing a strong bullish movement.

Let’s see the upcoming price direction from the KLAY/USDT technical analysis:

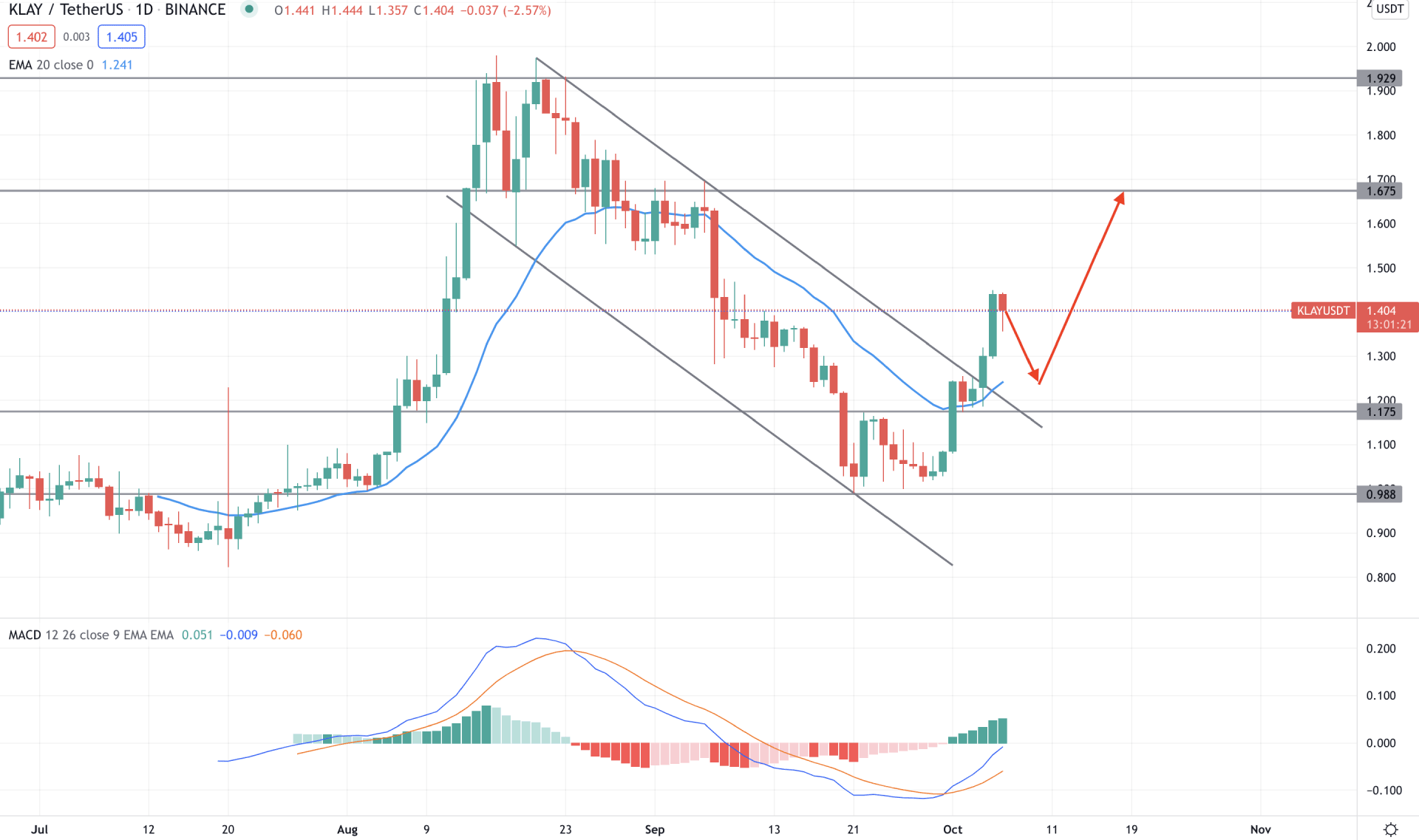

KLAY/USDT missed by $0.02 to test the $2.00 level in mid-August this year. Later on, the price moved down, followed by the broader crypto market correction and found a bottom at 0.988 level. After that, the price increased with an impressive bullish recovery and moved above the dynamic 20 EMA with a bullish daily close. Therefore, as the price is trading above the 1.175 static support and dynamic 20 EMA, it is more likely to extend the bullish pressure in the coming days.

The above image shows how the price moves above the dynamic 20 EMA with a strong bullish pressure while the MACD Histogram turns bullish. Moreover, the bullish pressure is supported by a channel breakout with a bullish daily candle. Therefore, based on the daily context, KLAY/USDT is more likely to move up towards the 1.675 or 1.929 level in the coming days. However, the bullish channel breakout is still juvenile, where a bearish correction is still pending. In that case, any bullish rejection from 1.300 to 1.1750 may initiate a solid bullish trend.

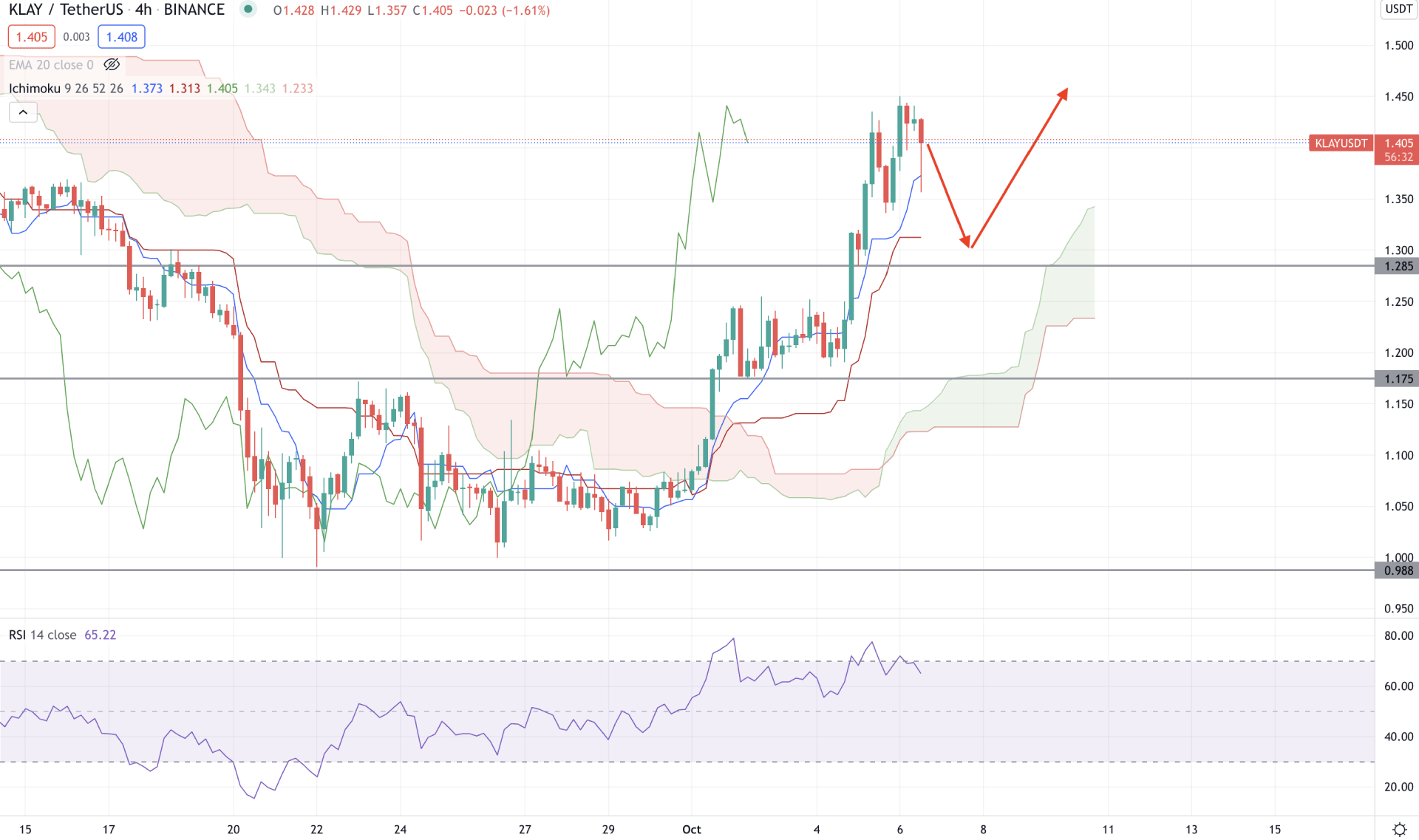

According to the Ichimoku Kinko Hyo, KLAY/USDT is trading within a solid bullish pressure as the price moved above the Cloud resistance with an intense buying pressure where the Tenkan Sen remained above the Kijun Sen. In the future cloud, Senkou Span A moved above the Senkou Span B with a substantial gap. Therefore, KLAY/USDT may grow higher in the coming session based on the future cloud and lagging span’s position.

The above image shows how the Tenkan Sen and Kijun Sen works as minor support to the price where the current H4 is rejected from the Tenkan Sen level. However, the RSI does not support bulls as the RSI level failed to hold a strong position above the overbought 70 levels. Therefore, profit-taking from bulls may create a correction in the price, but the bullish possibility is solid until the price comes below the 1.175 support level.

Based on the H4 context, a minor correction is pending but bulls may regain the momentum from 1.35 to 1.285. Therefore, any bullish rejection from that zone would be a high probably buying position where a break below the 1.175 may alter the current market structure.

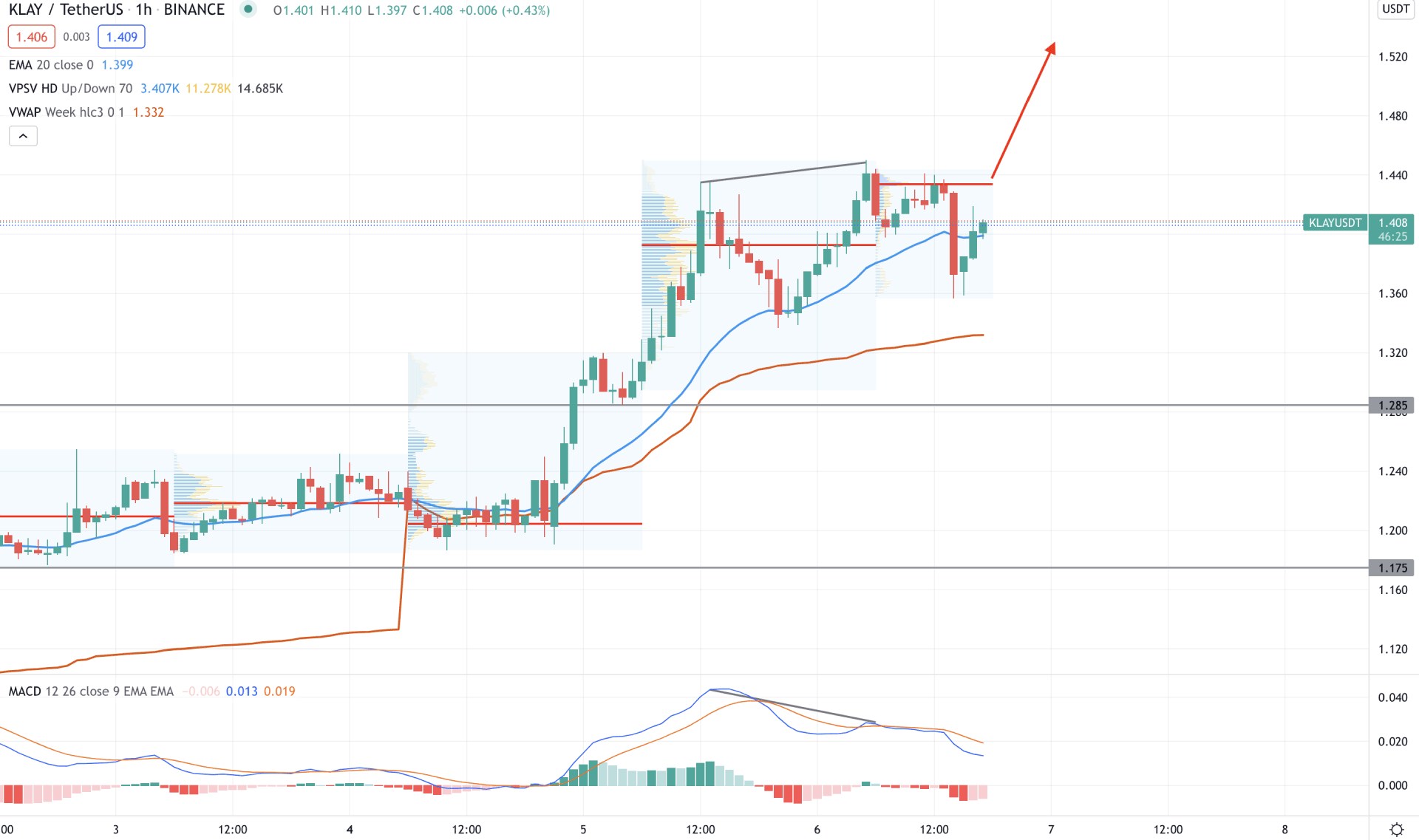

LAY/USDT is moving within a bullish pressure in the intraday chart as the price breaks out from the 1.20 level with a massive volume. Later on, the price made two swing highs where the most recent price is below the high volume level of 1.433 level.

The current price is trading above the dynamic 20 EMA and weekly vwap, but investors should wait for a correction to complete. The price moved below the dynamic 20 EMA with the support from regular divergence with MACD that may increase the bearish sentiment in the coming hours. Therefore, any bullish H1 close above the 1.433 high volume level may intensify buying pressure towards the 1.65 level. On the other hand, a break below the intraday vwap level may start a broader correction.

As of the above findings, we can say that the overall market momentum is bullish for the KLAY/USDT daily and H4 chart. Therefore, the price has a higher possibility of extending the bullish pressure towards 1.965 and even 2.00 level. On the other hand, a break below the 1.175 level may alter the current market structure and initiate a broader correction.