Published: May 21th, 2020

The EUR/NZD currency pair has been consolidating for 6 weeks and it just starting to look like the accumulation phase has come to an end. Considering the length of the consolidation, this could be a substantial move that will occur any time now. It is worth mentioning that the mover on this pair is likely to be the New Zealand Dollar rather than the Euro. The NZD does look extremely strong compared to most major fiat currencies, and EUR/NZD could be one of those pairs to feel NZD power.

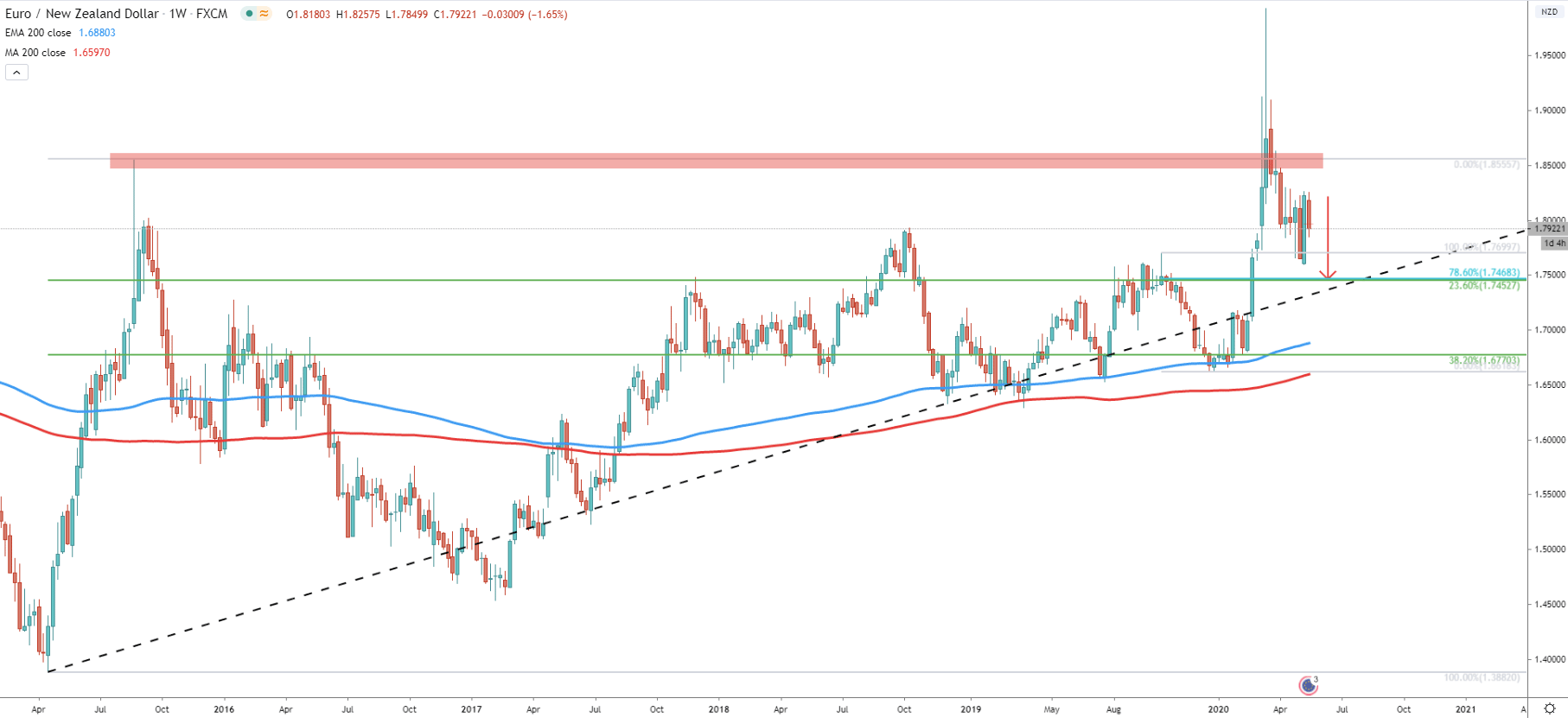

Starting of with the Weekly chart, EUR/NZD has produced a double top near 1.8555. Back in August 2015 pair already tested this resistance level and price has topped out. This time, there was a re-test of this resistance which has been rejected. At the first glance there was a break above, although the price has only produced a spike above, and then failed to close above the spike. This could mean that the resistance is holding, which proves that EUR/NZD has produced a double top.

The Fibonacci retracement applied to the initial uptrend occurred between April and August 2016, shows that the nearest support is at 23.6% retracement level, which is 1.7452. Another Fibs applied to the October - December 2019 corrective wave down, shows that 78.6% Fibs also corresponds to the 1.7452 support area. At the same time, if the price will move towards the target, it will also test the long term uptrend trendline, which is yet another confirmation of the support zone at this price.

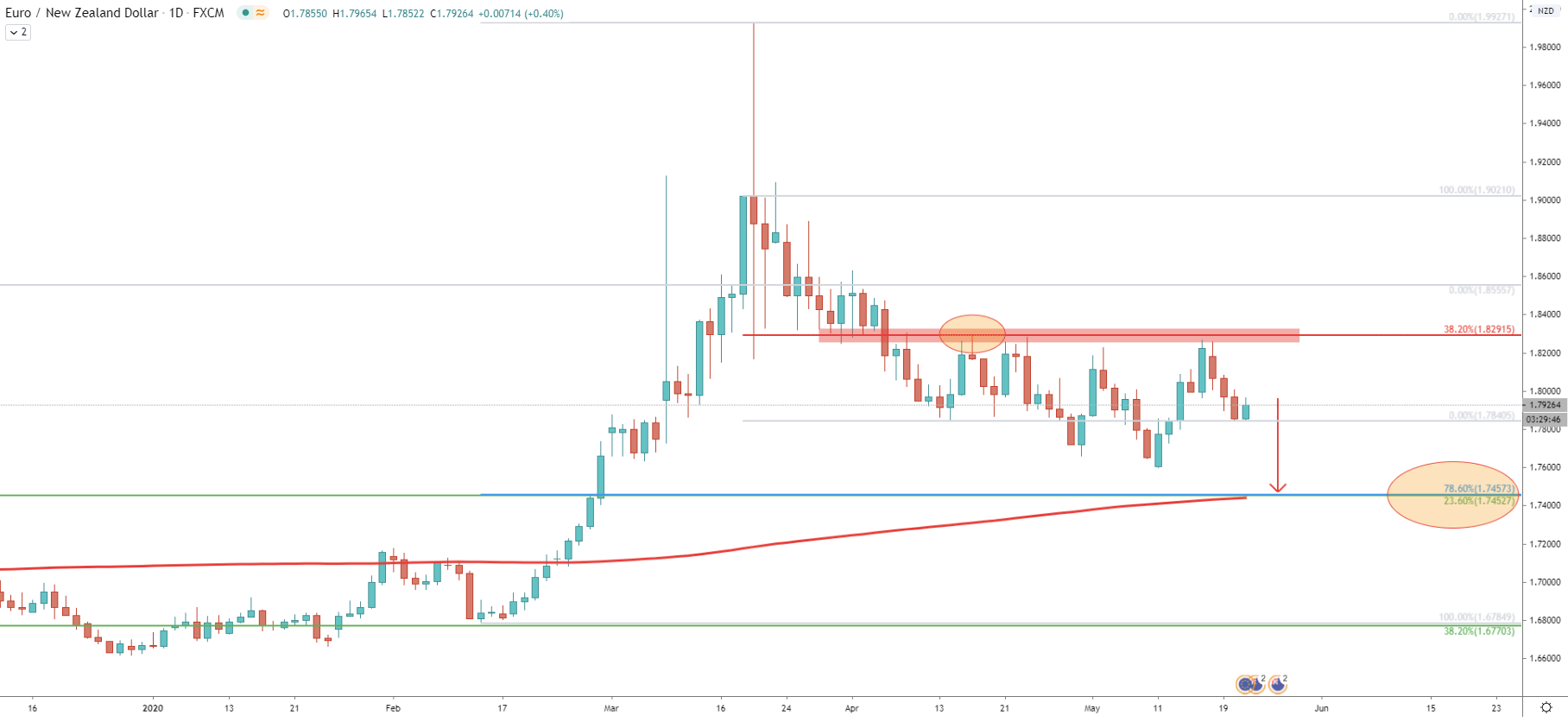

On the Daily chart, Fibonacci was applied to the first wave down, after the price has reached 1.9927 high, which occurred between March 19 - April 14. It shows that at 1.8291 massive resistance has been formed, confirmed by the 38.2% retracement level. This resistance area has been rejected 4 times in a row, and after each rejection EUR/NZD produced a new lower low. This confirmes the validity of the downtrend, or perhaps the continuation of the correctional phase from the overall long term uptrend. On this chart, the 1.7452 downside target also corresponds to the 78.6% Fibs, applied to the February 13 - March 19 wave up. Moreover, it also corresponds to the 200 Simple Moving Average, making it an extreme area of demand over the long term.

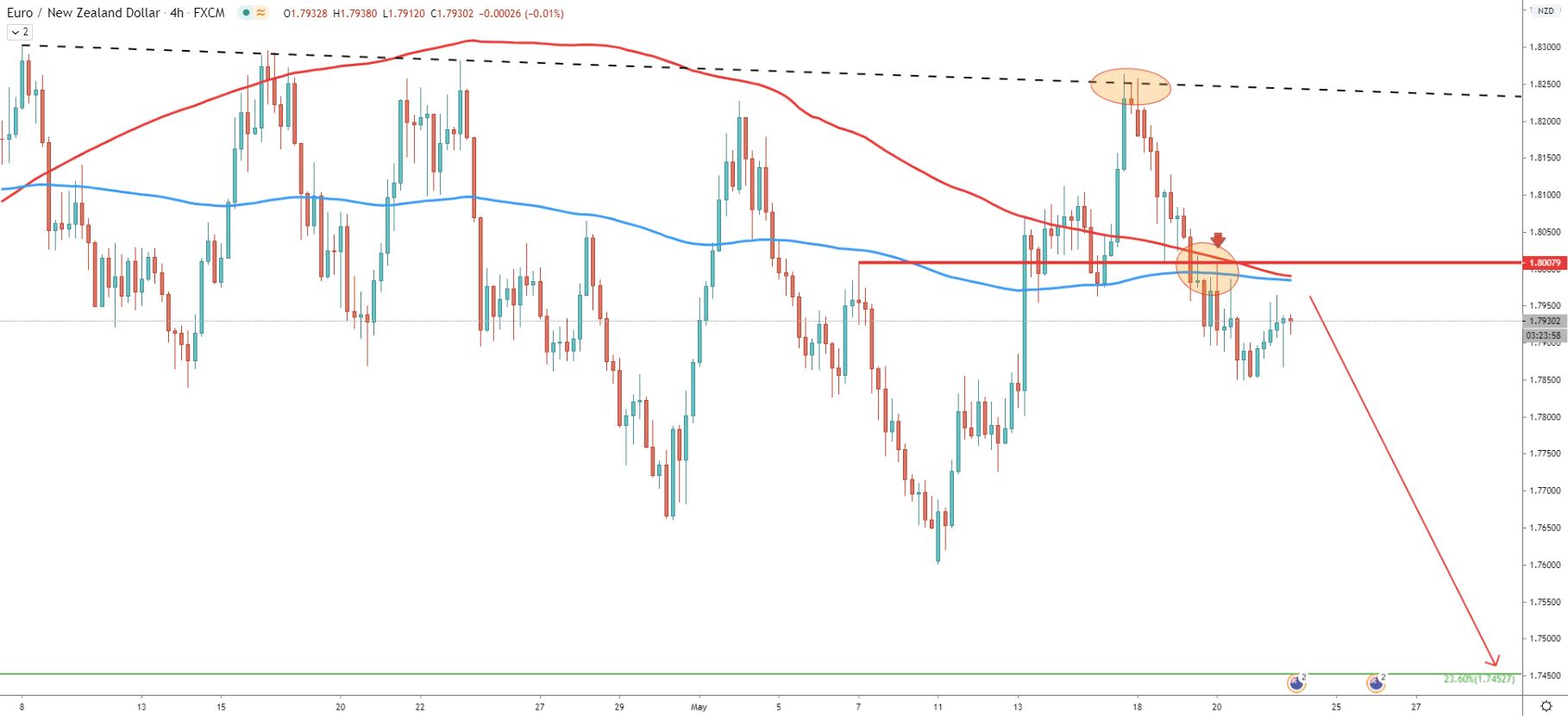

The 4-hour chart shows that price continues to reject the downtrend trendline, with the most recent bounce occurred on May 15. After that, price went down sharply and broke below both 200 Moving Averages, Simple and Exponential. Clearly, the bears are now in control, especially after price bounced off the previous level of resistance and the 200 SMA at the same time. This level is 1.8008, and it is also a strong psychological price, which in the short term, could play a key role. Because as long as the price will remain below this level, EUR/NZD will move down and will move substantially.

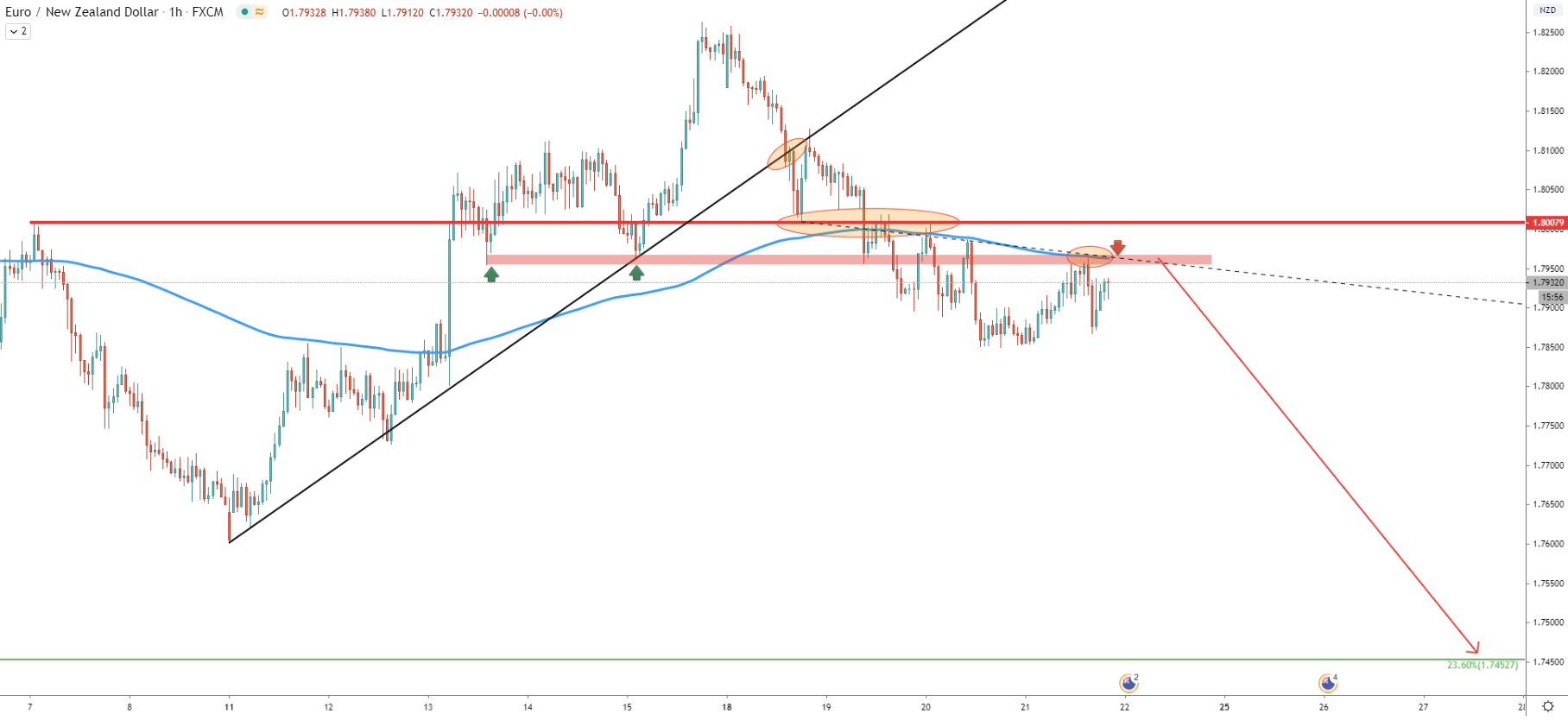

Finally, we are going to have a look at the 1-hour chart, where the uptrend trendline already was broken. Previous level of resistance at 1.8008 has been rejected, and exactly at the same spot was rejected the 200 Exponential Moving Averages. Price produces lower lows and lower highs and continues to reject the EMA, Besides, previously formed support 1.7965 was rejected today. Perhaps this is the very beginning of a very strong downtrend on EUR/NZD, which might result in a 600 pips decline

On each of the timeframes we can see that price continues to reject all possible resistance indicators and levels. This confirms that there is a heavy selling pressure on EUR/NZD and right now sellers’ domination is growing exponentially.

Confirmed by multiple Fibonacci retracement levels, uptrend trendline, and 200 Simple Moving Average, the key support is seen at 1.7452 level.

As has been mentioned, the key resistance is seen at 1.8000 phycological level, and to be more specific at 1.8008. This is the area of strong supply and if penetrated, with a daily close above, bulls will take over and the long term uptrend will most likely continue.

Support: 1.7850, 1.7452

Resistance: 1.7965, 1.8000