Published: July 29th, 2020

Yesterday we’ve shared analysis on the CHF/JPY and mentioned the correlation of the Swiss Franc and Gold. While the gold uptrend could have exhausted itself after a very strong rally, time for the correction down could be just around the corner. This means that CHF might follow this path and multiple CHF pairs will move against the Franc. Today we’ll analyze the EUR/CHF currency pair and will look into the price potential in the coming days and weeks.

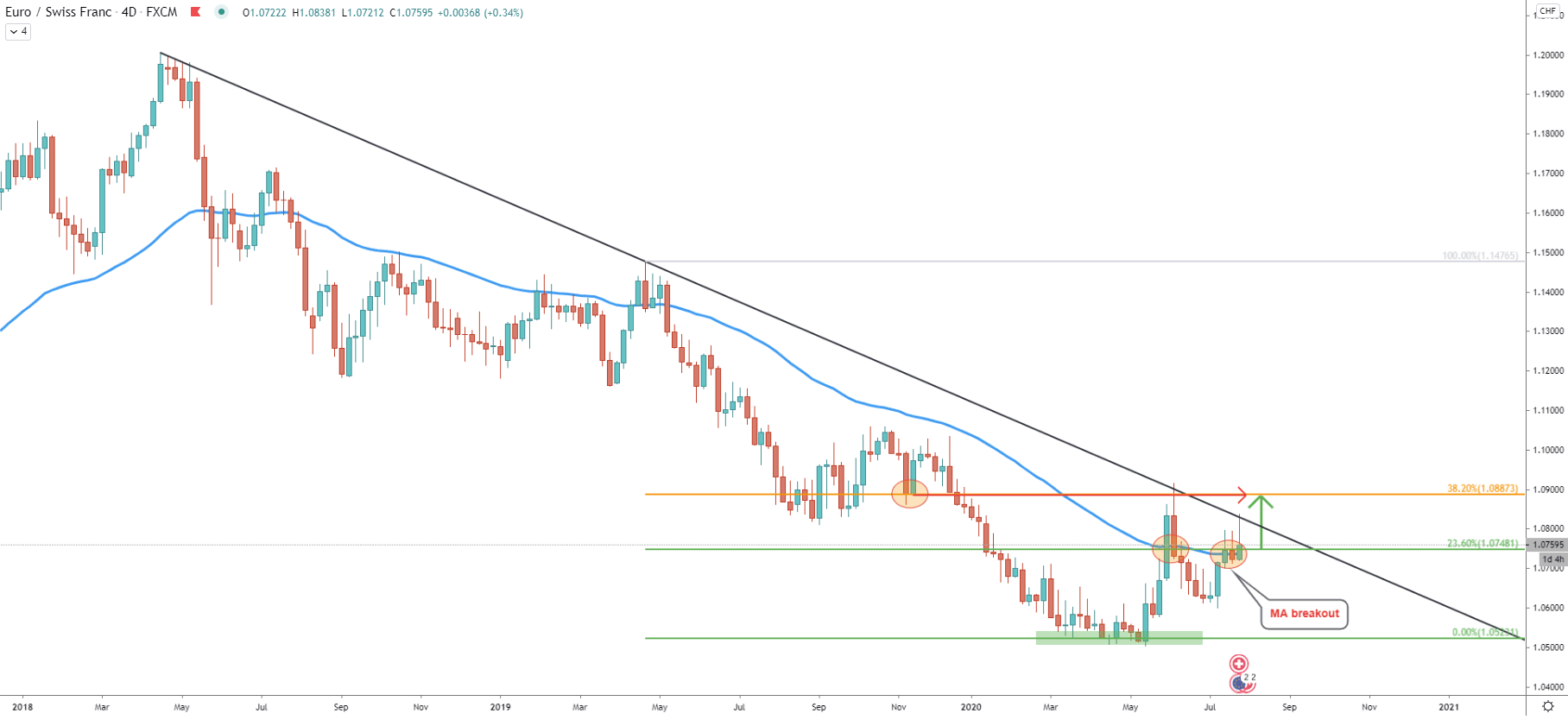

Starting off with the 4-hour chart, where consistent downtrend was taking place between April 2018 - May 2020. In May price bottomed out while testing the low at 1.0500, an extremely strong psychological support. EUR/CHF has been trading near this support area for nearly two months. But on May 18 pair went up sharply and the upside correction resulted in a 412 pip move which took only 14 days.

EUR/CHF has broken above the 50 Exponential Moving Average and reached the previously established resistance as well as 38.2% Fibonacci retracement level at 1.0888. After that pair corrected down but throughout this week price is showing some strength once again. We can see that the 50 EMA and 23.6% Fibs were broken for the second time, suggesting a dominating buying power. This might send the price up once again, potentially to re-test recent high and 38.2% Fibs at 1.0888.

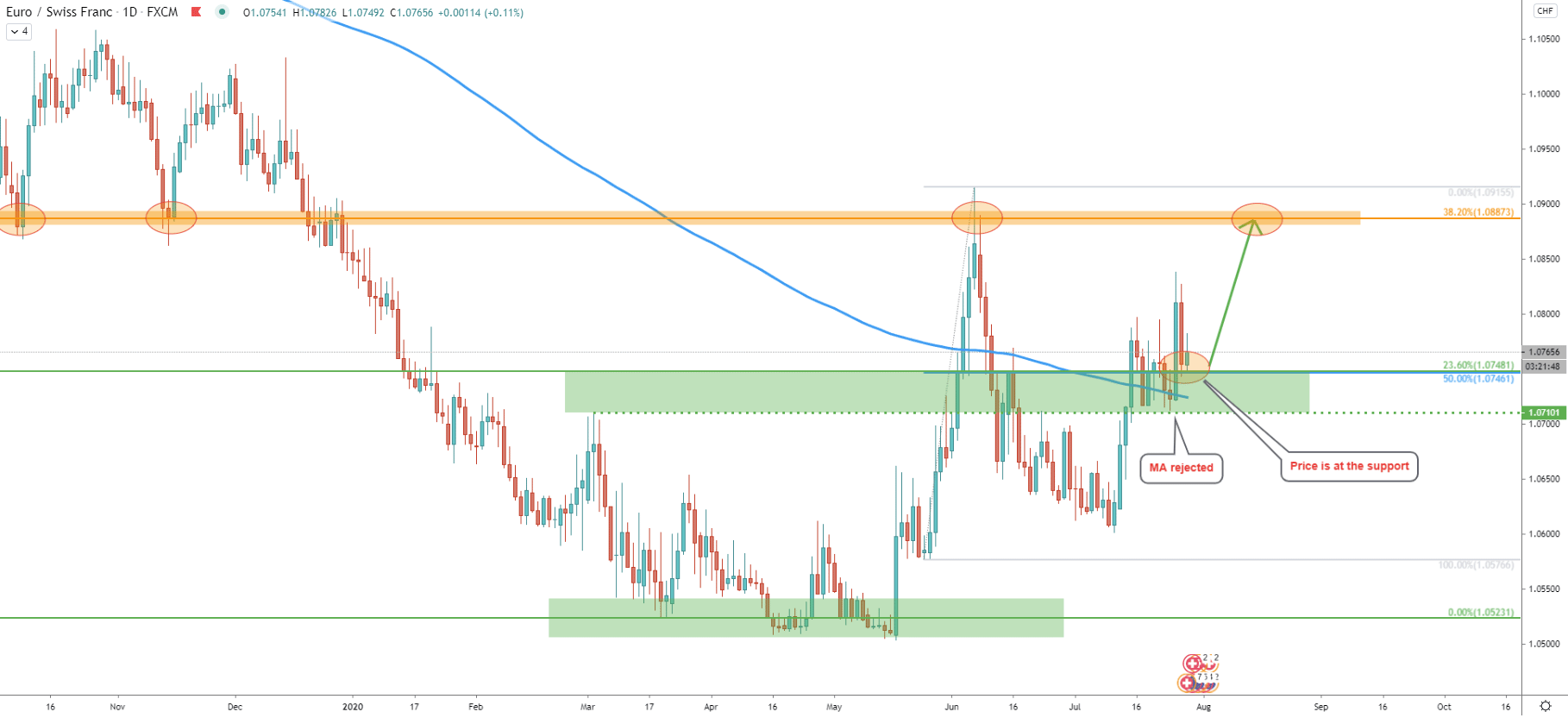

This week EUR/CHF has rejected the 200 Simple Moving Average and today’s price remains right at the key support level which is 1.0746. This support is confirmed by two Fibs, first being 23.6% retracement level as per the 4-day chart, and second is 50% Fibs applied to the May 25 - June 5 wave up.

Based on the previous level of resistance we can clearly see the current area of support located between 1.0710 - 1.0746. As long as the price remains in this area or above, EUR/CHF will continue the journey north, with a potential for 120 pip growth in the near future.

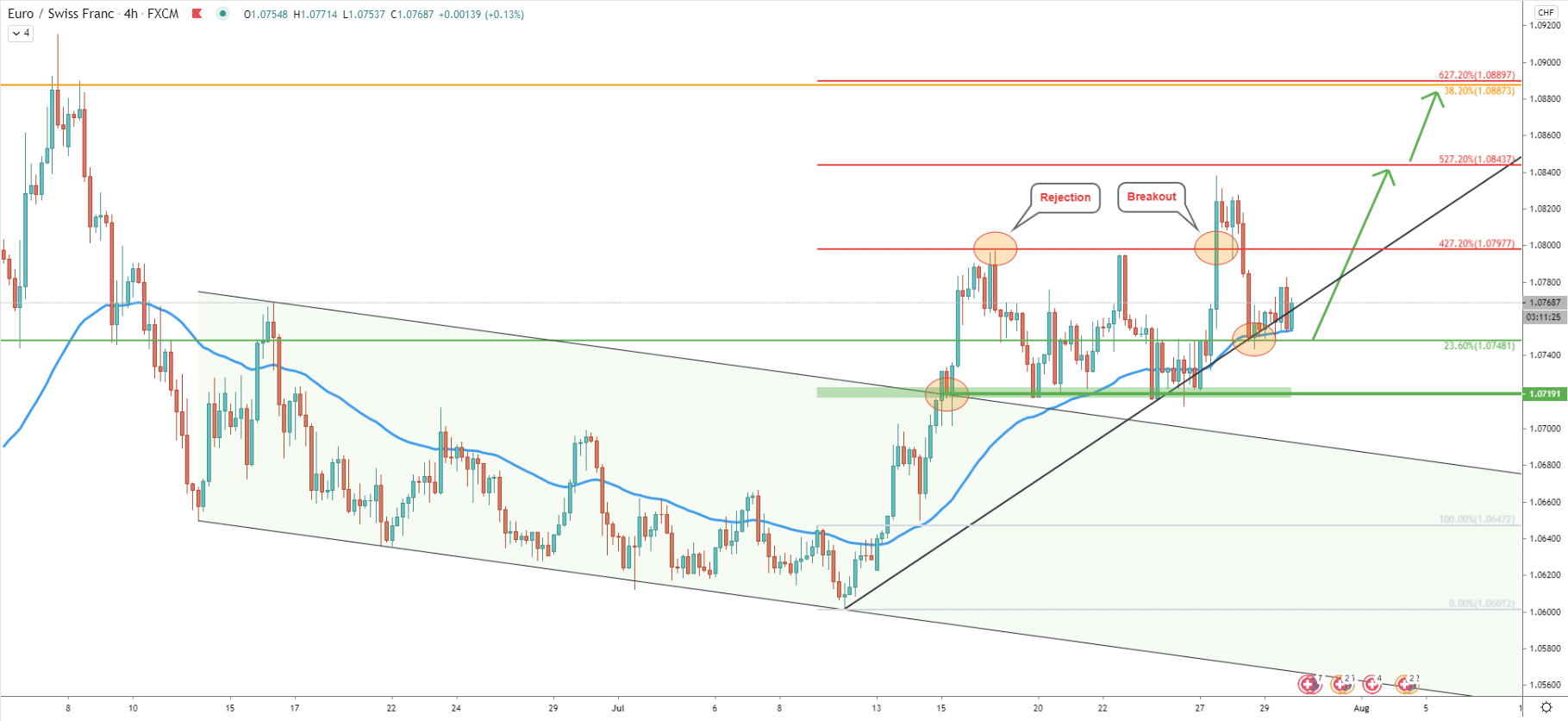

On the 4-hour chart, EUR/CHF broke above the descending channel and rejected 427.2% cleanly. Fibonacci retracement level was applied to the last wave down, where 1.0600 support was tested. The correction down followed and the channel breakout point at 1.0797 has been acting as the support during 3 trading weeks. There were multiple bounces off this support and after EUR/CHF broke above 1.0800 psychological resistance, Bulls have won the battle for the trend. Such a price action should be inviting more buyers in the short to medium term and considering current downside correction, the EUR/CHF buying opportunity can be very attractive. All-in-all the bullish trend validity has been confirmed while today EUR/CHF rejected 50 EMA along with the simple uptrend trendline.

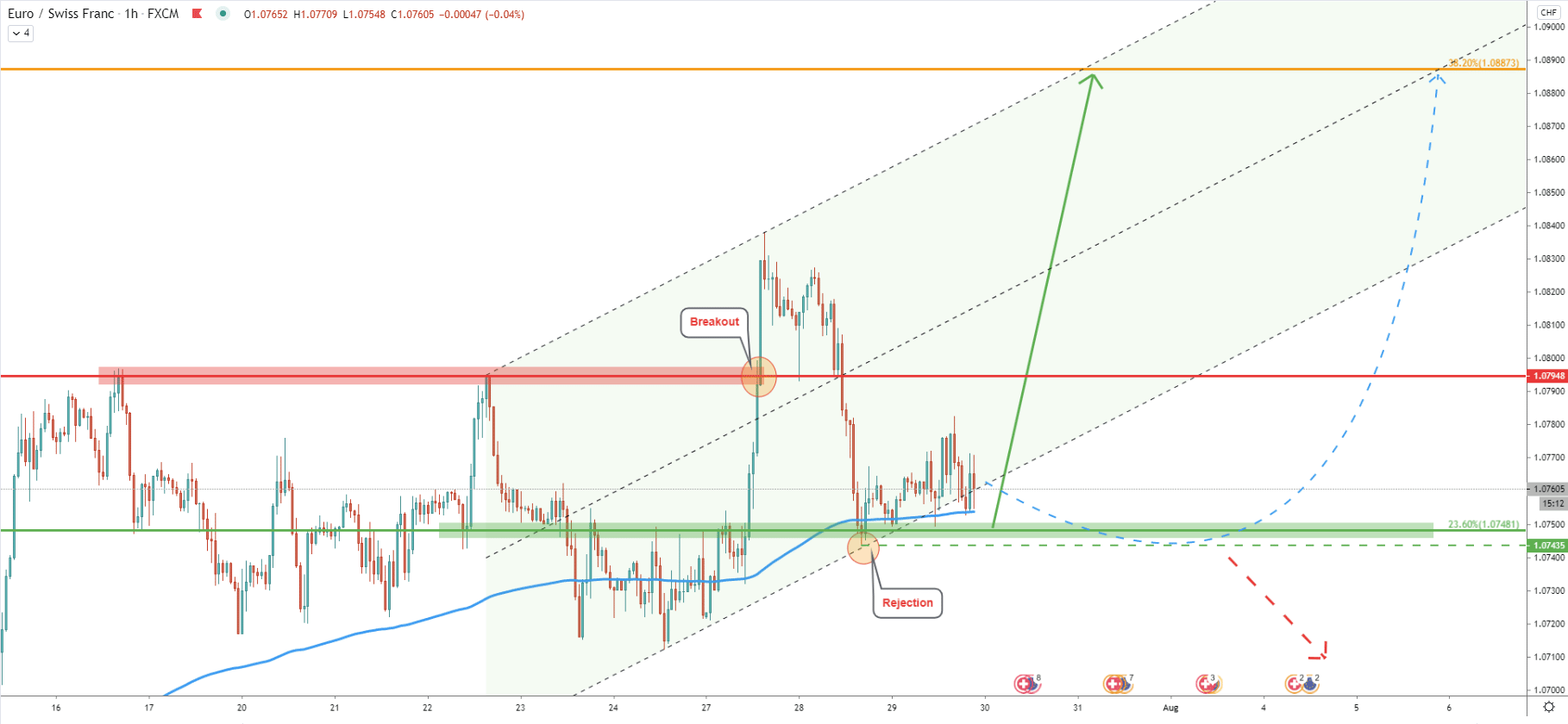

On the hourly chart, EUR/CHF has reached and rejected the bottom of the ascending channel and currently, the price remains near the very strong demand zone. Price is above the 200 EMA and the upside perspective seems to be bright. Nevertheless, consolidation phase might take place where the price will continue to range near the 1.0748 support area. It is also possible that on the daily chart EUR/CHF will produce spike/s below this support, and it is important that daily close will remain above. Because only Daily break and close below this level will invalidate bullish outlook and price can be expected to move down substantially.

The overall Swiss Franc sentiment across the board could be changing, which should result in a correction on multiple CHF pairs. The same applies to the EUR/CHF which already started to correct up, but this could only the beginning of a much stronger upside move.

As per the Daily and 4-hour chart, key resistance is seen at 1.0888 and is confirmed by two Fibonacci retracement levels. This resistance area goes inline with the previously established high, which means taht EUR/CHF can produce a double top near that price area.

The trend is strongly bullish and probability of a trend reversal is very low at this point in time. Nonetheless, Daily break and close below 1.0743 will invalidate expected uptrend and the long term downtrend will most likely continue.

Support: 1.0743, 1.0700

Resistance: 1.0844, 1.0888