Published: July 7th, 2021

In the cryptocurrency market, Bitcoin and other top-tiered cryptocurrencies moved higher yesterday while Dogecoin was trading slightly lower. Last day, Bitcoin gained almost 1% to $34,240 while Ethereum surged more than 4% to $2324. In the meantime, Dogecoin remained calm at 0.$2350 area.

The broader selling pressure in the cryptocurrency market came from the Chinese regulator’s action against crypto-related service providers. Moreover, China increased the focus on the crypto industry, especially on mining, trading, and providing services. As a result, many miners shut down their business operations while others decreased their activity.

On the other hand, one of the major cryptocurrency exchanges, Binance, announced to suspend depositing money from euro SEPA accounts, as reported Tuesday. As a result, customers from Eurozone will no longer be able to deposit through the SEPA payments area, and its effect might make the crypto recovery questionable.

Let’s see the future price direction from the Dogecoin technical analysis:

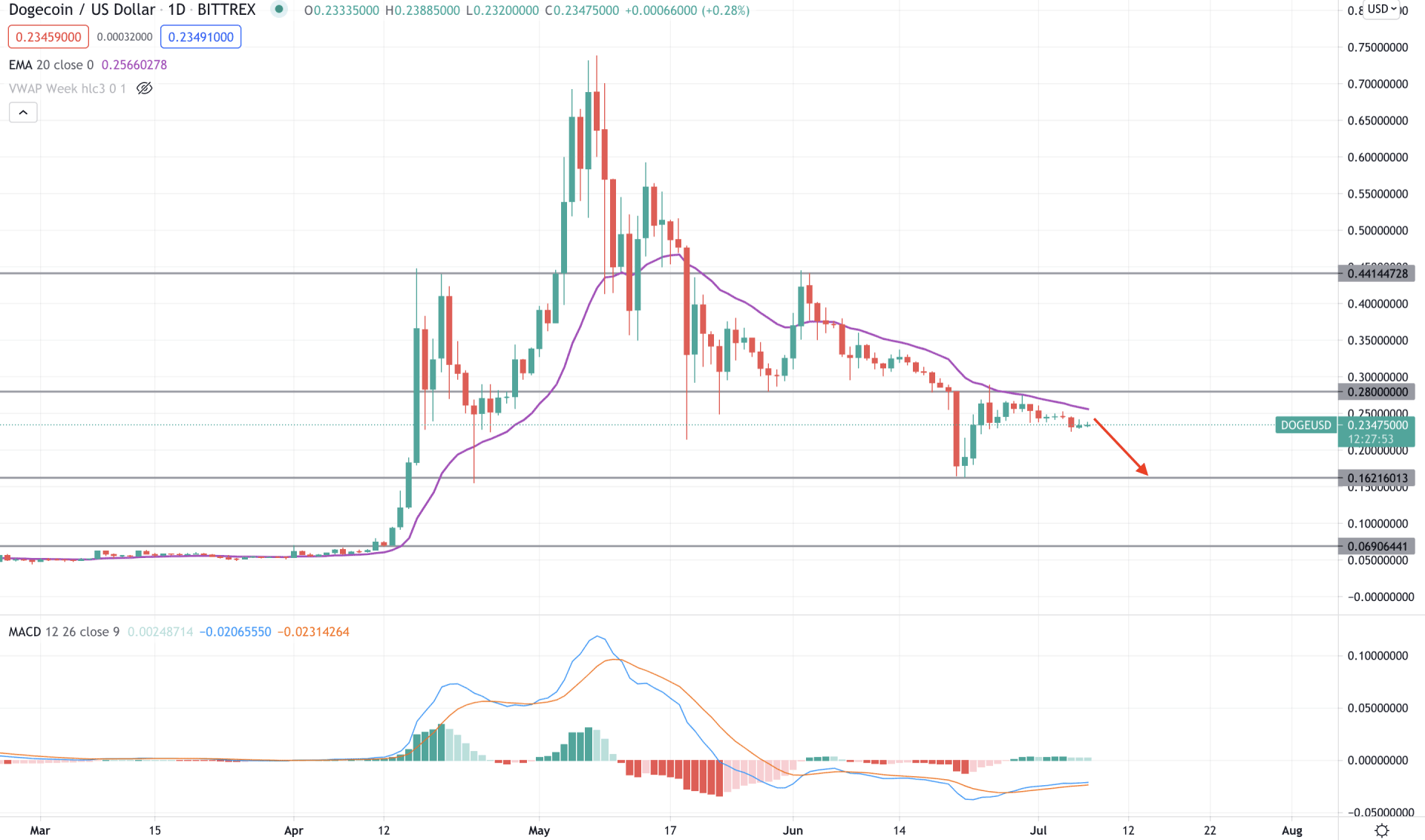

Dogecoin showed an impulsive bullish pressure from mid-April that topped the price at 0.7369 level within a month. Later on, the price started to crash due to the Chinese crypto ban, and still there is no sign of recovery in the price chart. Therefore, as long as the price is trading below the 0.2800 event level, it has a higher possibility of continuing the bearish pressure in the coming days.

In the above image, we can see the daily chart of Dogecoin where the price tried to break below the 0.2800 level multiple times in May. Later on, the price corrected and made a daily close below it with intense selling pressure. Moreover, the price corrected higher but failed to hold the momentum above the 0.2800 level. Moreover, the dynamic 20 EMA is above the price and working as a resistance. In that case, the price has a higher possibility of continuing the bearish pressure towards the 0.1621 support level.

On the other hand, MACD Histogram is still above the zero lines where any negative histogram may increase the selling pressure to the price.

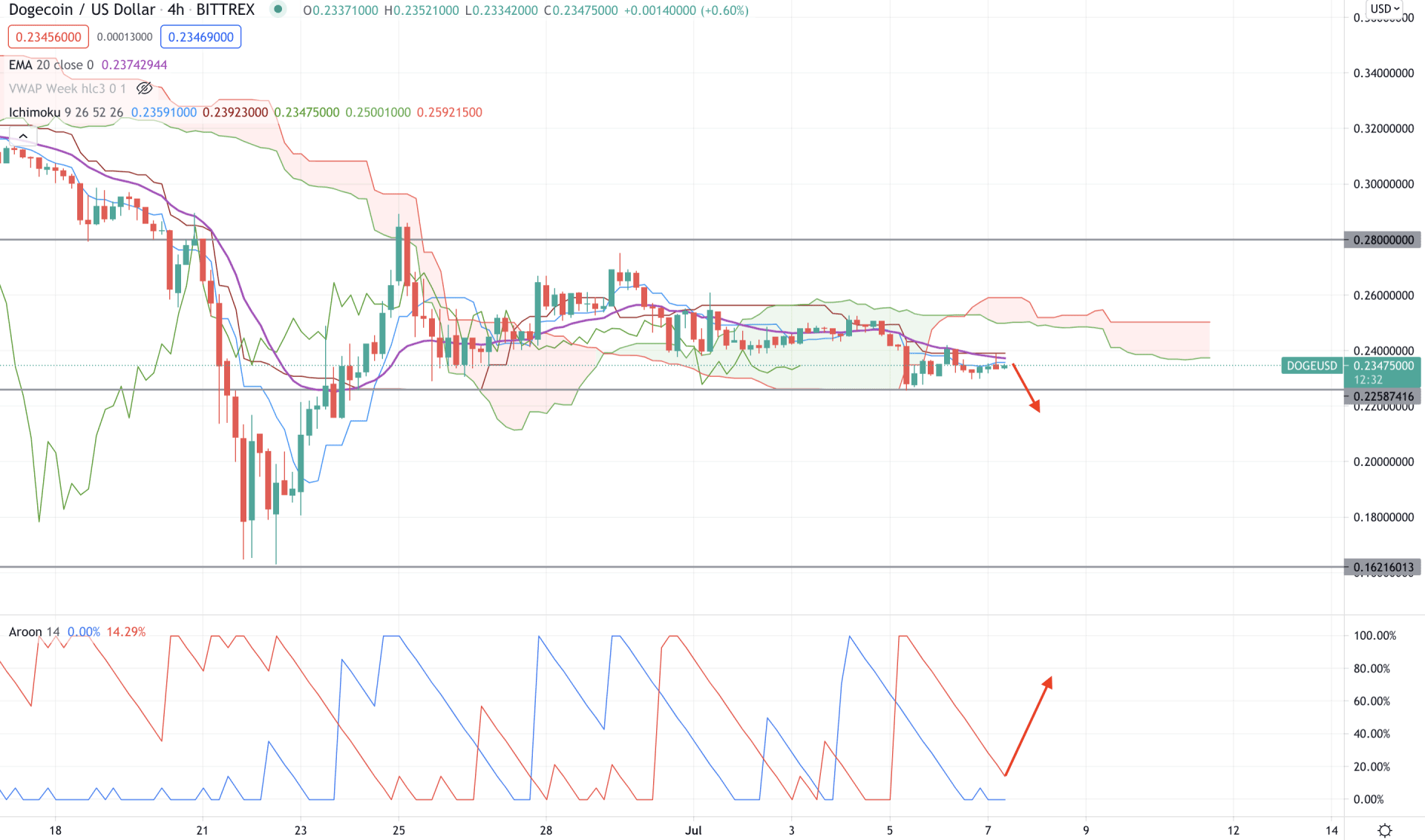

If we plot the Ichimoku Kinko Hyo on the Dogecoin H4 chart, we see that the price is moving down with intense selling pressure. The most recent price is below the Kumo Support, while the Senkou Span A is below the Senkou Span B, in the future cloud. Moreover, the dynamic Tenkan Sen and Kijun Sen are above the price and working as dynamic resistance. Therefore, as long as the price is trading below the dynamic Kijun Sen, it may move lower in the coming sessions.

In the indicator window, Aroon Down (red line) is above the Aroon Up (blue line), indicating that the market trend formed bearish and doing a correction. If the Aroon Down moves above the 60% level, the price may move lower with an impulsive pressure.

However, the most recent horizontal support is at 0.2258 level, and a strong bearish H4 close below this level is important for the upcoming bearish pressure. On the other hand, a strong bullish H4 close above the 0.2500 level starts a broader correction to the price.

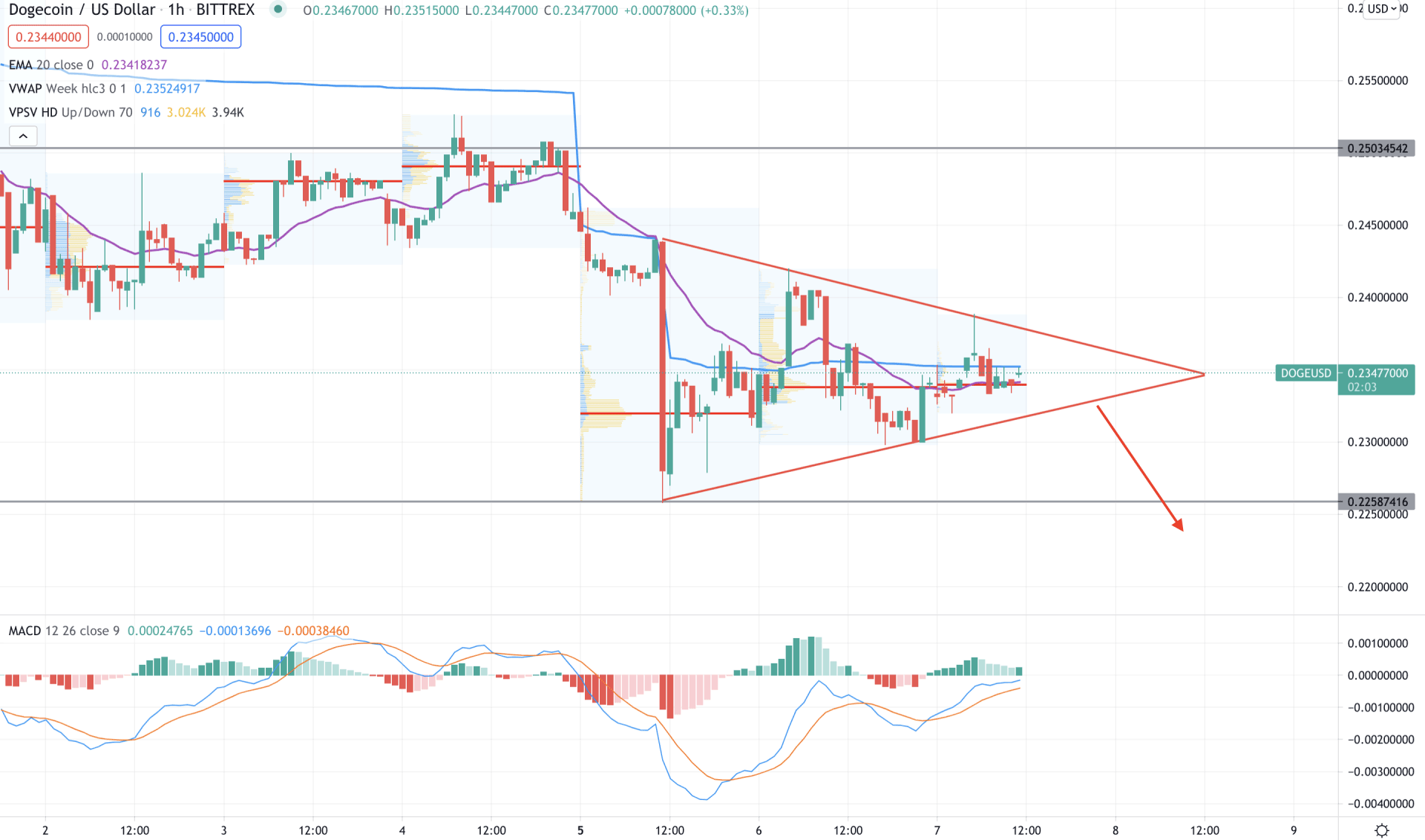

In the intraday chart, the price is within a symmetrical triangle where a breakout is pending before showing directional bias. As the broader market trend is bearish, any break down from the triangle level would initiate a high probable selling pressure.

The above image shows that the price is within a correction and trading above the high volume level at 0.2339. However, the gap between the current and previous high volume levels is closer, so investors should focus on how the price reacts at the 0.2258 support level. Any solid bearish H1 close below the 0.2258 level may take the price lower in the coming session.

On the other hand, MACD Histogram is still bullish, where a stable price above the 0.2500 level may consider the current bearish trend invalid.

As of the above discussion, we can say that EURJPY has a higher possibility of coming lower towards 0.1621 support level as long as the price is trading below the dynamic Kijun Sen in the H4 chart.

On the other hand, any strong bullish H4 close above the 0.2500 level may increase the buying pressure to the 0.400 level.