![Coinbase Stock [COIN] Bulls are Aggressive Above $281.00 Level](https://d3kvcd8uuqwmxt.cloudfront.net/filecache/articles_img/tech-analysis-main-page.jpg_810_61700f194e1168.86217909.jpeg)

Published: October 20th, 2021

Coinbase is one of the biggest cryptocurrency exchanges in the US that listed more than 50 crypto assets for trading, including Bitcoin, Ethereum and Litecoin. Bitcoin moved almost 2% this year after significant downward pressure in recent months. On the other hand, Ethereum value has doubled this year.

Coinbase allows people to deposit cryptocurrencies in exchange for a certain percentage as a charge, which is the top way to make money. More than 90% of the company’s revenue came from trading and transaction services in 2020. Since the formation, Coinbase estimated its first-quarter revenue to arrive at $3.07 a share with $1.81 billion. However, the actual report came at $3.05 a share or $1.201 billion, representing an 11.3% market share of the overall cryptocurrency market.

Later on, on 10 August, Coinbase released its Q2 result that came with $6.42 a share against the revenue of $2.22 billion. The company projected that Q2 and Q3 might come lower due to the lower trading volume. However, the recent news listing Bitcoin Futures ETF might push the overall cryptocurrency market to boom. As a result, Coinbase stock has a higher possibility of following the momentum with a price appreciation.

Let’s see the upcoming price direction from Coinbase Stock [COIN] technical analysis:

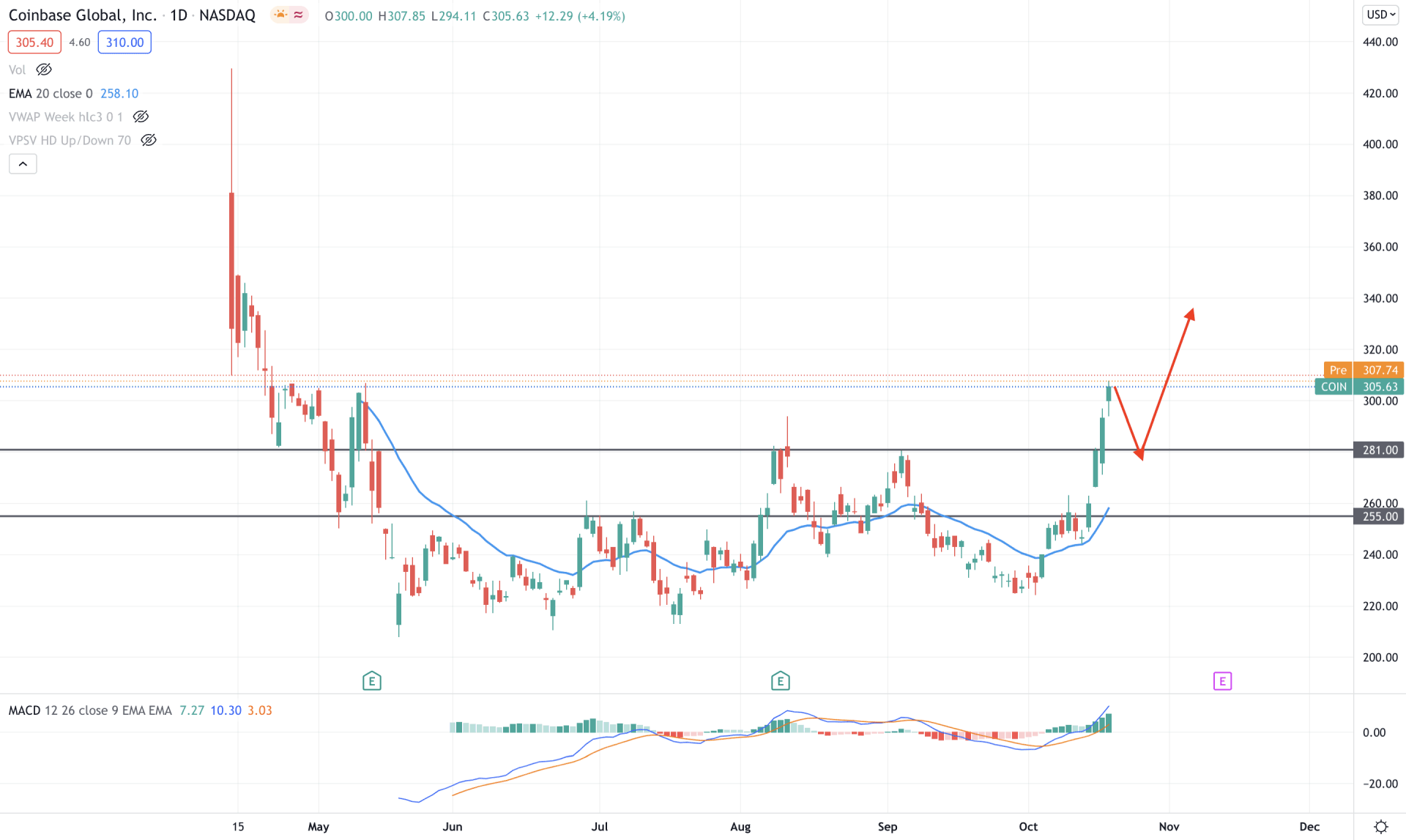

Coinbase Stock pushed lower as soon as it was listed on the US Stock Exchange. The price moved down immediately from 440.00 level to 210.0 level within the first trading month. However, the price found the bottom at 210.00 areas it failed to break below this low for more than five months. Later on, the price moved higher above the 255.00 event level with an aggressive bullish pressure that made bulls have a strong position above the 281.00 level.

The above image shows how the price is trading above the 281.00 level and dynamic 20 EMA. Meanwhile, the MACD Histogram is positive and aiming higher. As a result, the gap between the price and dynamic 20 EMA is extended while a correction is pending after the breakout above the 281.00 level.

Based on the daily price action, Coinbase Stock [COIN] has a higher possibility of moving up considering the recent bullish price action in Bitcoin and news regarding Bitcoin Futures ETFs regulation. Therefore, a bearish correction towards 281.00 to 260.00 level would increase the buying possibility with the target of 400.00 level in the coming days.

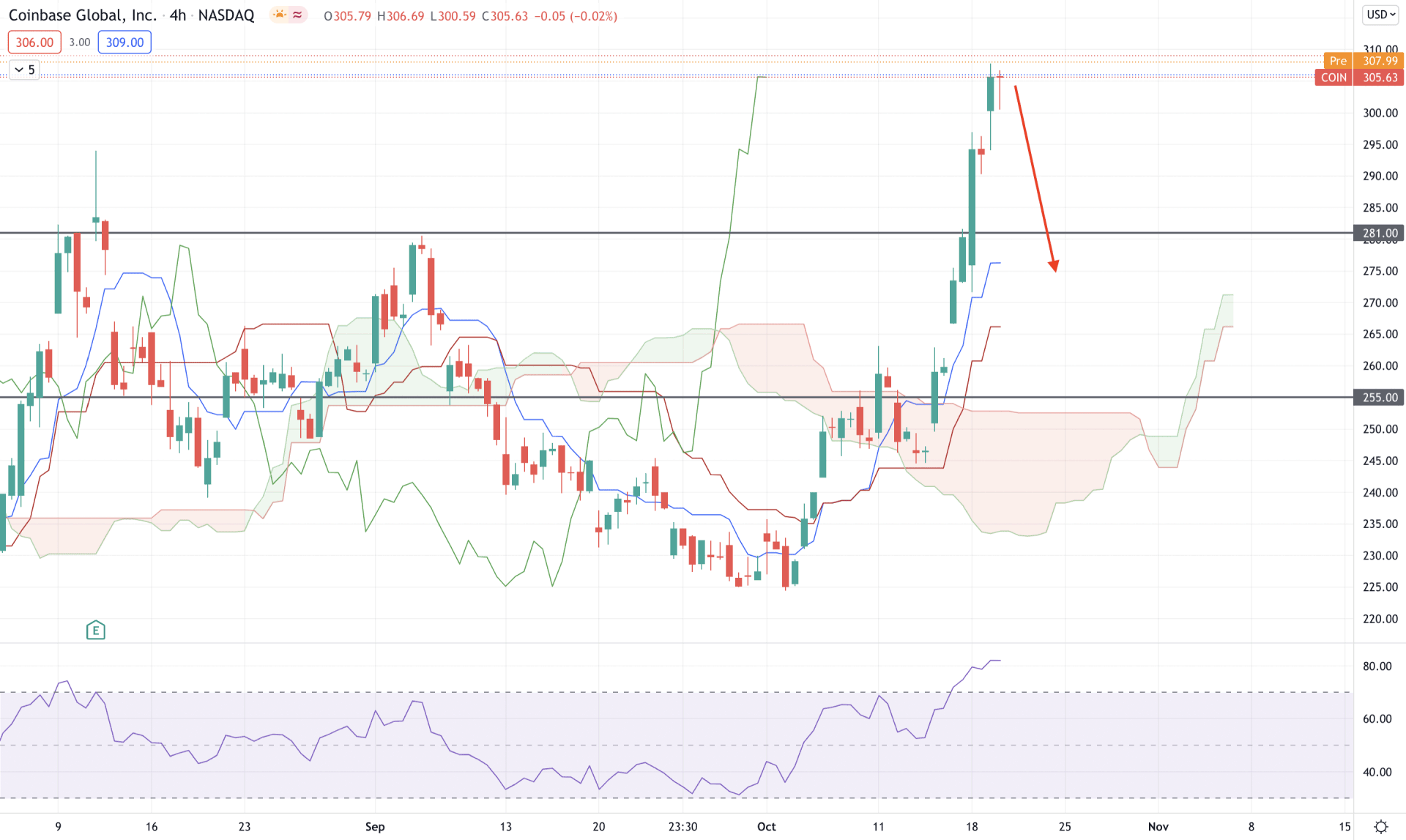

According to the Ichimoku Kinko Hyo, Coinbase Stock [COIN] moved above the Kumo Cloud with an extreme bullish pressure that helped bulls breach the 281.00 static resistance level. However, the intense bullish pressure created a gap between the price and dynamic Kijun Sen. On the other hand, the future cloud remains bullish, and the lagging span moves above the price.

The indicator window shows that the RSI level moved above the overbought 70 levels, indicating that the price is exceptionally bullish and a correction is pending. Therefore, based on the H4 context, we can say that the Coinbase Stock [COIN] has a higher possibility of correcting lower in the coming days. However, the bullish potential is valid as long as the price is trading above the 255.00 support level. A break below the 255.00 level may resume the broader correction in the price.

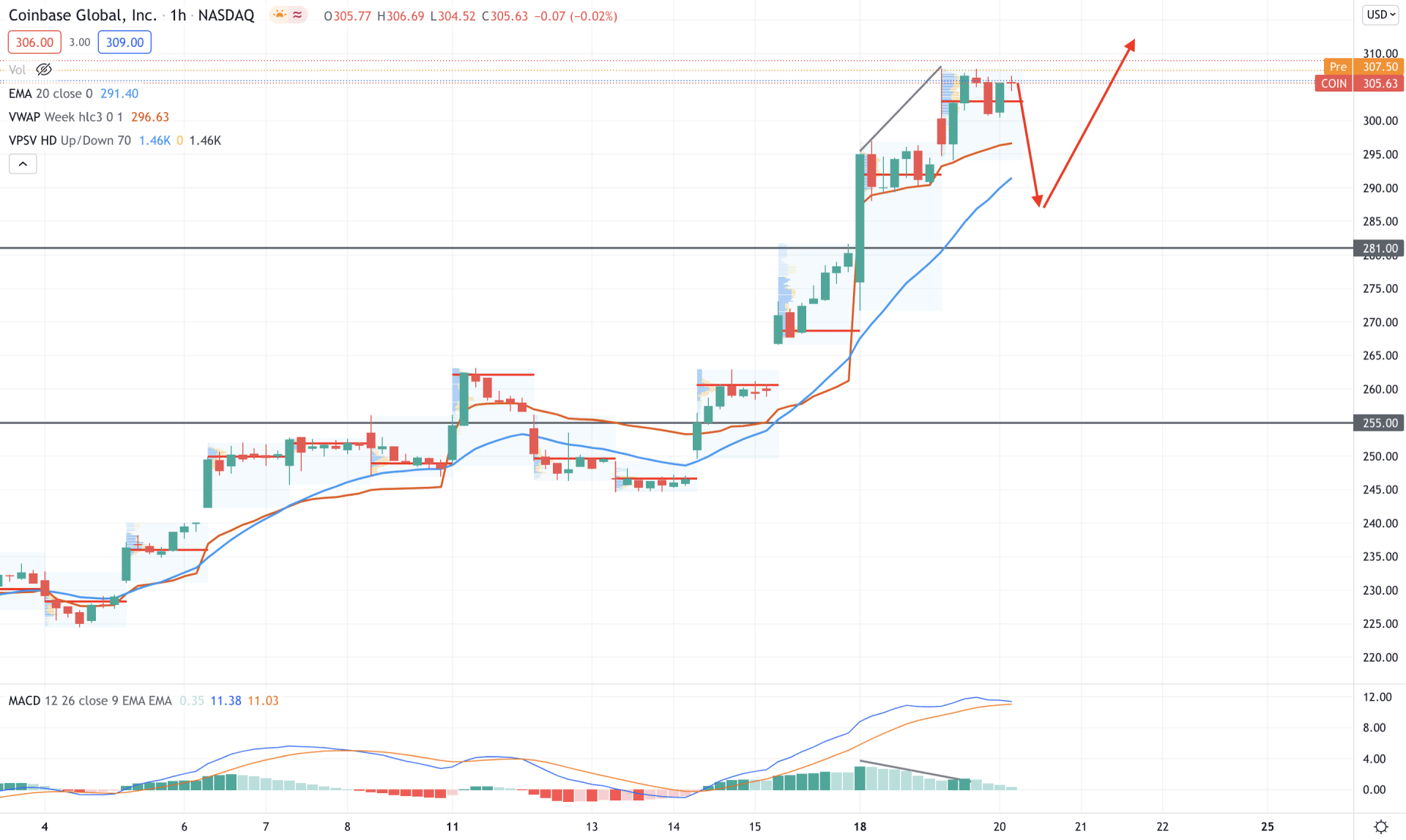

In the intraday chart, we can see that the Coinbase Stock [COIN] is trading above the dynamic 20 EMA and weekly VWAP, where the most recent high volume level is at 302.89 level. Therefore, as long as the price is trading above the dynamic 20 EMA, we expect the bullish pressure to extend.

The above image shows how the price moved above the 281.00 resistance level and formed a hidden divergence with MACD Histogram. Therefore, based on the H1 context, COIN is more likely to show a bearish correction in the coming hours. However, a bullish rejection from dynamic VWAP of static 281.00 level may resume the current bullish pressure towards the 400.00 level.

As of the above discussion, Coinbase Stock has a higher possibility of moving up in the coming days until the price breaks below the 281.00 level with a bearish daily close. The bullish pressure may extend towards the 400.00 level in case of approval of the Bitcoin Futures ETFs. Conversely, a stable price below the 281.00 level may initiate a deep correction towards the 255.00 or 200.00 area.