Published: April 22nd, 2021

AUDUSD is trading within the range between 0.7824 to 0.7580, backed by a long-term uptrend. As the current price is trading in the middle of the range, there is a possibility of testing any of the corners before setting the final price direction.

AUDUSD showed a mixed sentiment as soon as the Retail Sales releases took the price higher near the 0.7824 resistance. Australian retail sales came at 1.4% m/m against the previous months -0.8%. The increase in retail sales came from the ease in lockdown restriction nationwide, with the rise in shopping more than usual due to the Easter holiday.

Furthermore, the Reserve Bank of Australia is very optimistic about the Australian Economy as the overall economic activity is recovering from the COVID-induced recession. Despite the better-than-expected Retail Sales report, AUDUSD failed to have a daily close above the 0.7580 resistance level. So, what might happen in the future? Let’s see the price direction from the AUDUSD technical analysis.

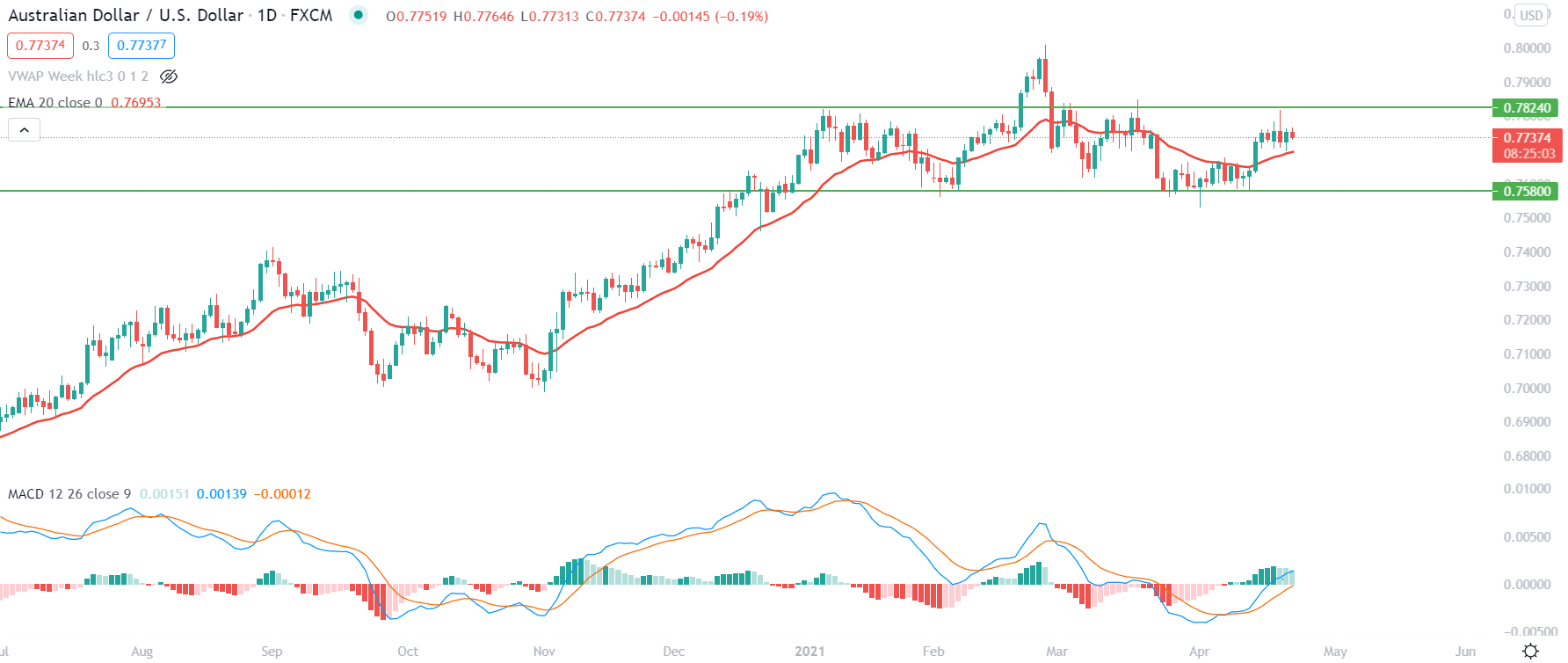

Based on the daily chart, the price is trading within the range between 0.7580 to 0.7820 level. Therefore, traders may find a clear price direction after breaking below or above this zone.

Currently, the price failed to have a daily close above the 0.7820 level and closed with a bearish pin bar after the Retail Sales release, indicating that bears became active in the price. Therefore, the price may test the 0.7580 level, the lower part of the range. However, the current barrier is the dynamic 20 EMA, which is approaching the price. In this situation, if the price has a daily close below the dynamic level of 20 EMA, it may move lower in the coming days. Moreover, MACD Histogram is bullish but unable to make new highs. The primary target of the bearish pressure would be 0.7580 level,

On the other hand, a bearish rejection from the dynamic 20 EMA may increase the bullish pressure in the price towards 0.7820 level. However, to get a high probable bullish setup, investors should wait for a daily close above the 0.7820 level.

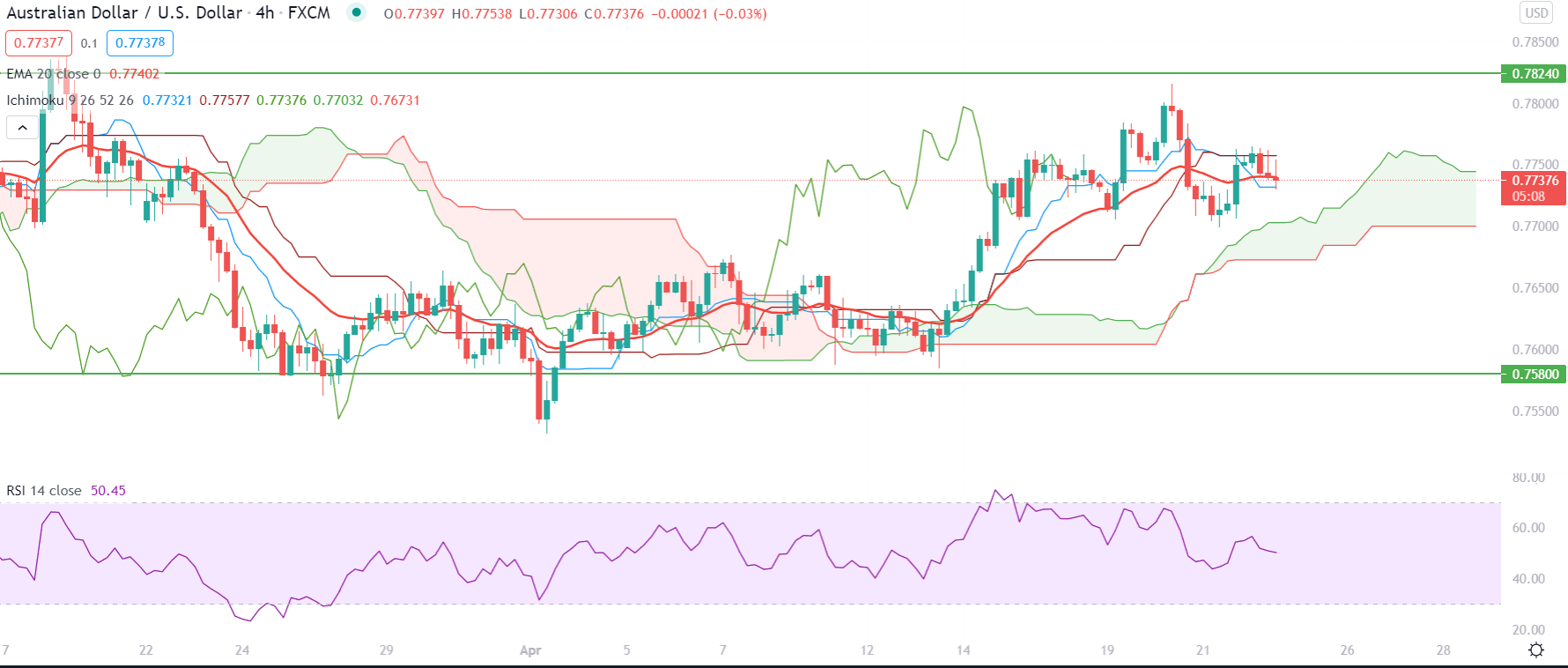

In the H4 chart, AUDUSD faces a correction as the price came below the Kijun Sen line. As long as the price is trading below the Kijun Sen, it may move lower towards the Kumo Support.

In the above image, we can see that the price faces a minor resistance from the dynamic 20 EMA and Kijun Sen while the Tenkan Sen is Below the price. Therefore, any solid bearish daily close below the Tenkan Sen may take the price towards 0.7674, Kumo Support.

Besides, RSI started to move lower from the potential 70 levels and currently residing at 50 levels. Therefore, it has a higher possibility to come more down, expanding the bearish pressure in the price. Moreover, any H4 close below the 0.7674 support would lower the price with the target of 0.7580.

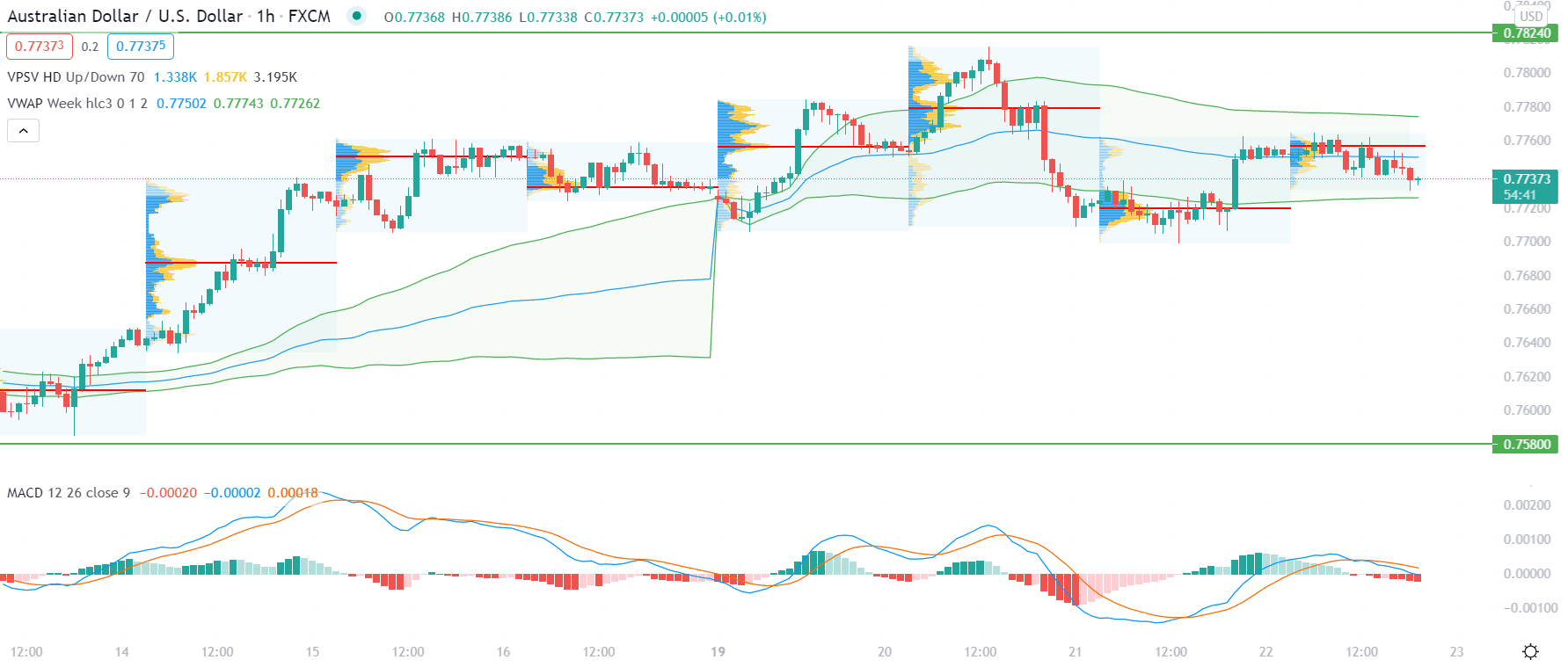

In the intraday chart, AUDUSD is very volatile as the volume of recent sessions shows mixed direction. However, the price is currently trading below today’s high volume area and the vwap level. Therefore, we may expect some bearish pressure until the US session closes.

Based on the H1 chart, yesterday’s high volume area was at 0.7720 level, and the price is currently approaching that level. Moreover, today’s high volume is above the price that may work as minor resistance. Therefore, any solid H1 close below 0.7720 may increase the bearishness in the price.

On the other hand, the vwap level with bands is moving lower, and the price moved lower below teh vwap level with an H1 close. Therefore, any H1 close below the lower band of vwap may take the price more down in the coming sessions.

Besides, MACD is still bearish in the H1 chart, and Histograms are making new lows. Based on this condition, a strong H1 close below the 0.7720 level may allow bears to control the price.

As of the above discussion, we can say that AUDUSD has a higher possibility to continue the bearish pressure if the daily candle closes below the Dynamic 20 EMA. In that case, the primary target would be 0.7580.

On the other hand, any strong bullish H4 close above the 0.7760 Kijun Sen level may increase the buying pressure when the primary target would be 0.7820 resistance.